us exit tax percentage

In 2019 the maximum was 105900. This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home.

Green Card Exit Tax 8 Years Tax Implications at Surrender.

. Exit tax applies to United States expatriates a term describing people who have renounced their US citizenship and those who have renounced a Green Card that they have held for at least eight years out of the. As the percentage of this amount that you must pay as part of your exit tax is based on your marginal tax rates it is likely to be different for everyone currently it cannot be any higher than 238. Status they are subject to the expatriation and exit tax rulesBut the rules are not limited to.

The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance. Generally if you have a net worth in excess of 2 million the exit tax will apply to you. Legal Permanent Residents is complex.

The exit tax is a tax on the built-in appreciation in the expatriates property such as a house as if the property had been sold for its fair market value on the day before expatriationThe current maximum capital gains rate is 238 which includes the 20 capital gains tax and the 38 net investment income tax. Long-term resident with dual residency in a treaty country. Date commencing to be treated for tax purposes as a resident of the treaty country.

Citizen will be subject to provisions of the exit tax. The IRS requires certain expats to calculate an exit tax when they exit the US and file their 10401040NR tax return along with Form 8854. Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them.

The total amount of the gift is reduced by the annual gift exclusion 13000 in 2011 and then subject to the highest marginal. The IRS Green Card Exit Tax 8 Years rules involving US. You will also be taxed on all your deferred compensation.

In some cases you can be taxed up to 30 of your total net worth. Through the FEIE US expats can exclude up to 107600 of their 2020 earnings from US income tax. The number of Americans who gave up their citizenship more than tripled to about 6700 in 2020 from a year before.

Exit Tax Expatriation Planning. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. The Exit Tax Planning rules in the United States are complex.

Citizens who expatriate in 2020 there may be IRS exit tax consequences. Citizens Green Card Holders may become subject to Exit tax when relinquishing their US. Tax is imposed when distributions are made to a covered expatriate at which time the trustee of a nongrantor trust must withhold 30 of the taxable portion of the distribution Sec.

US Exit Tax IRS Requirements. The general proposition is that when a US. The exit tax is essentially the application of US income tax on the portion of that phantom gain that exceeds US690000 as of 2015 as.

Exit Tax or apply for a bond which can be very expensive. If the covered expatriate does not meet the aforementioned criteria then the deferred compensation is taxed as income based on the. Depending on what the total gain is if the gain exceeds the exemption amount currently 725000 the expatriate may have to pay a US.

If the payer of the deferred compensation is a US citizen and the taxpayer expatriating has waived the right to a lower withholding rate clarification needed then the covered expatriate is charged a 30 withholding tax on their deferred compensation. Date you became a citizen of each country listed in line 6a see instructions. The exit tax is generally payable immediately ie April 15 following the close of the tax year in which expatriation occurs.

Meanwhile a US recipient of gifts or bequests from expatriates who were subject to the exit tax is required to pay a tax on those assets at a 40 percent rate. The most important aspect of determining a potential exit tax if the person is a covered expatriate. For Green Card Holders and US.

Any gifts or bequests that you make as a covered expatriate to a US. The IRS adjusts this amount each year for inflation although the Trump tax reform in 2017 changed the inflation index to. The exit tax rules apply to citizens and Legal Permanent Residents Green-Card Holders who qualify as LTR Long-Term Residents.

The HEART Act also added the inheritance tax a 40 flat tax on the gross value of a covered gift or covered bequest made to a US. If you are covered then you will trigger the green card exit tax when you renounce your status. 877Af1AA covered expatriate can opt out of this method and elect not to use the wait-and-seeapproach and to instead accelerate income recognition.

Green Card Exit Tax 8 Years. Expatriation forms may result in FBAR penalties FATCA penalties PFIC tax passport revocation liens levies and examination. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain.

The failure to file the necessary US. It will be as though you had sold all of your assets and the gain generated was viewed as taxable income. With the introduction of FATCA Reporting increased aggressive enforcement Foreign.

Currently net capital gains can be taxed as high as 238 including the net. US tax increase 2021. Citizen renounces citizenship and relinquishes their US.

List all countries including the United States of which you are a citizen see instructions.

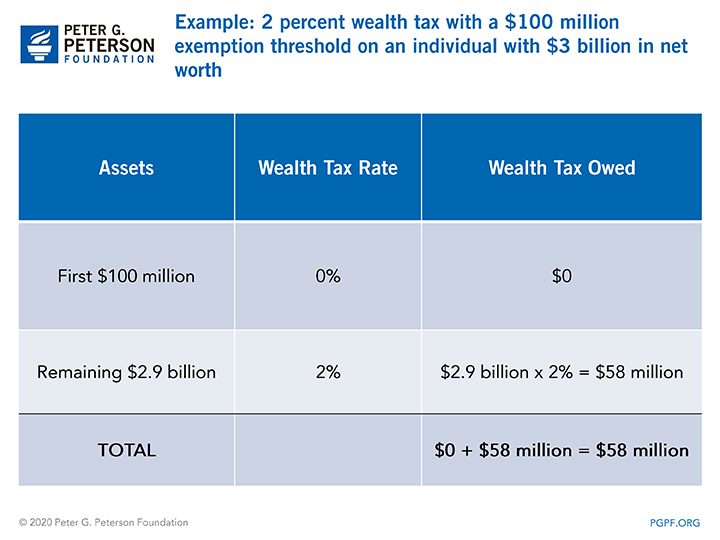

What Is A Wealth Tax And Should The United States Have One

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

What Is Expatriation Definition Tax Implications Of Expatriation

Exit Tax Us After Renouncing Citizenship Americans Overseas

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Here S How To Keep Your Us Citizenship And Pay Zero Taxes

Renounce U S Here S How Irs Computes Exit Tax

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

A Uk Company Is A Good Solution For Digital Nomads Tax Consulting Uk Companies Corporate Tax Rate

Tax Residency Is Not The Same As A Legal Residency In 2021

Us Taxes Worldwide Income Escape Artist

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax In The Us Everything You Need To Know If You Re Moving

Renouncing Us Citizenship Expat Tax Professionals

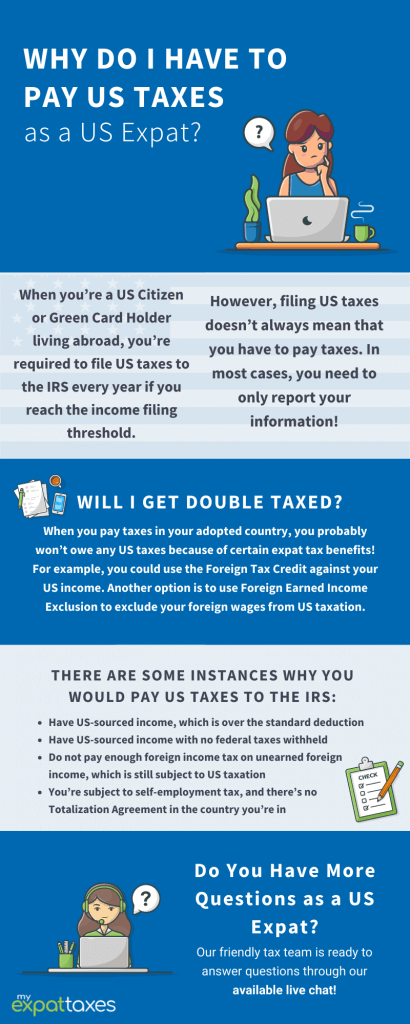

Paying Us Expat Taxes As An American Abroad Myexpattaxes

Long Term Capital Gain Tax Rate For 2018 19 Capital Gain Capital Gains Tax What Is Capital