car lease tax deduction calculator

For others they can no longer make monthly lease. You use the car for business purposes 75 of the time.

Commercial Lease Analysis Spreadsheet Spreadsheet Spreadsheet Template Lease

This will be your base payment.

.png)

. This is applicable for self-employed as well as salaried professionals. Total lease payments deducted in fiscal periods before 2021 for the vehicle. Acquisition Fee Bank Fee.

800 13 x 181 30 5454. Total Lease Payment Sales Tax 65. Leased car payments can be a personal or a business lease car depreciation does not apply to leased vehicles only works for new cars The actual cost method relies on the percentage of the business portion of the car usage.

Only the business portion of the tax can be written off. A car lease acquisition cost is a fee charged by the lessor to set up the lease. Finding out how much money it will cost to lease a new car truck or SUV is quick and easy with our lease calculator.

For example maybe the renters family has grown and the 2-seater convertible is not big enough or because of a new longer ride they want a more fuel-efficient vehicle. Leasing a vehicle could help you save as much as 30 on your taxes. Add Sales Tax to Payment.

For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699 before tax and your sales tax rate is 6 the monthly lease tax is 4194 in addition to the 699 base payment. For example even though Delaware has no state sales tax it currently charges a document fee of 425 of the purchase price of a vehicle or the NADA book value whichever is more. Multiply the base monthly payment by your local tax rate.

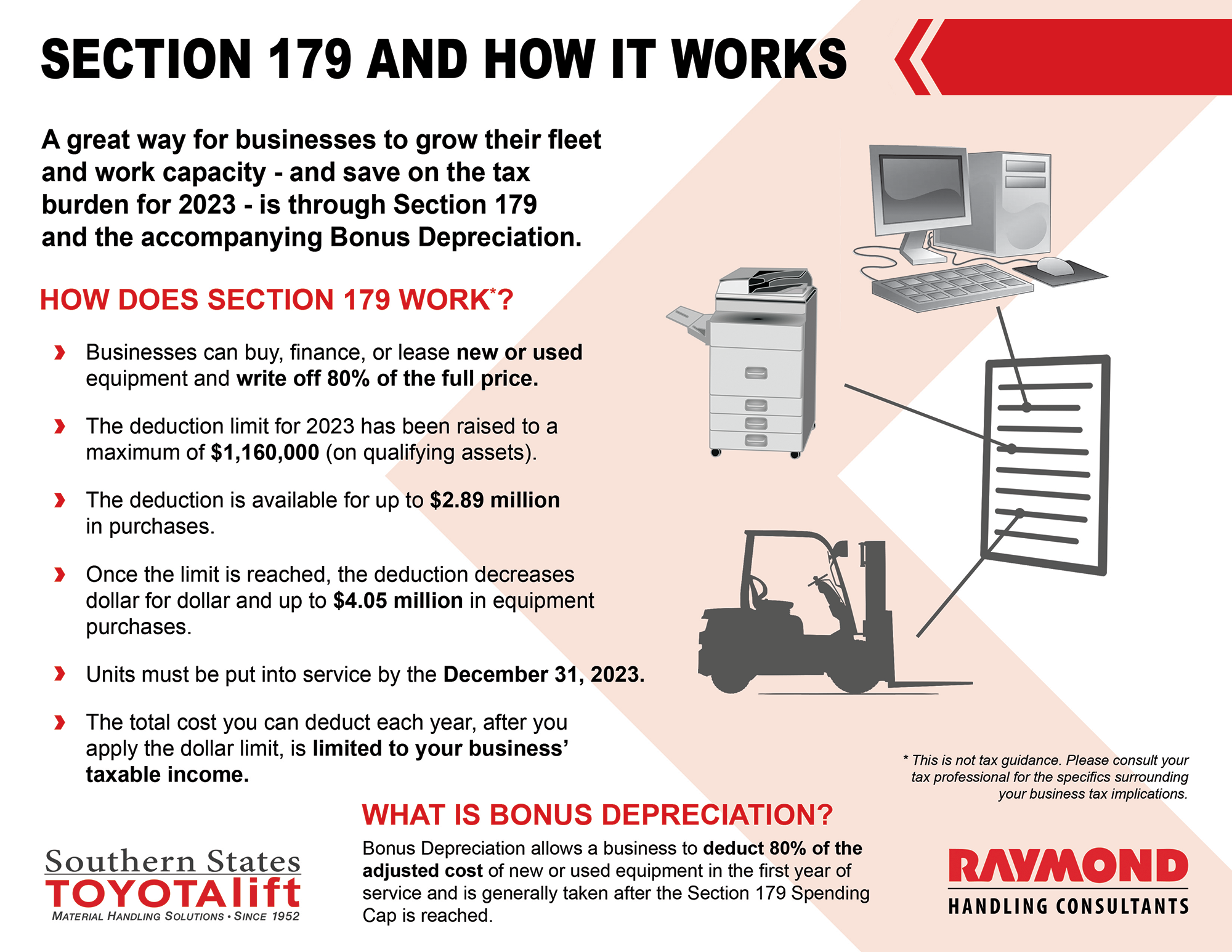

However if you use the car for both business and personal purposes you may deduct only the cost of its business use. This calculator lets you calculate your estimated lease payments. The deduction limit in 2021 is 1050000.

Right now you can use the BankBazaar website to lease a car from Revv. Pre-tax monthly payment 54760. It will be worth 30000 at the end of the lease so your lease cost before interest taxes and fees will be 15000 divided into equal monthly payments.

As the holder of the lease you are required to make a down payment followed by set monthly payments. This makes the total lease payment 74094. The acquisition fee will range from a few hundred dollars to as much a 1000 for a higher-end luxury car.

The same rules apply here as with the lease itself. Cap Cost Capitalized Cost is the negotiated price of the vehicle plus any other costs and fees that will be financed in the lease not paid up front. When you sign a contract to lease a car you are entering into a legally binding agreement that gives you the right to use that vehicle for a set amount of time and given certain terms and conditions.

510 Business Use of Car. 66 cents per kilometre for the 201718 201617 and 201516. The business deduction is three-quarters of your actual costs or 6000 8000 075.

Car Lease Tax Deduction Calculator. 72 cents per kilometre from 1 July 2020 for the 202021 and 202122 income years. You want the 50000 car and have negotiated the price down to 45000.

Leasing a car has more variables than buying a car but we are here to help shed some light on the ins and outs of auto leases. Monthly depreciation monthly interest amount monthly tax amount monthly lease payment. If you were to claim the Section 179 deduction you could take a 15000 deduction 20000 075 on your 2021 tax return which youd file in early 2022.

You can write off 240 for. The lease amount you pay for a vehicle is eligible for tax relief. GST and PST on 800.

Youll include it on your Schedule C under line 9 for Car and Truck Expenses with your other auto expenses. If you put 2000 down the. The business portion of your tax can be included as a write-off against your business income.

68 cents per kilometre for 201819 and 201920. Divide the depreciation amount by the number of months in your lease. Another common reason is a lifestyle change.

In this case the formula will look like this. You can claim a maximum of 5000 business kilometres per car. You can generally figure the amount of your.

Add the adjusted capitalized cost and the residual value. Now add GST and PST to 800 and multiply that amount by the total number of days you leased your vehicle during the year and divide the total by 30. If theres no sales tax in your state you can skip this step.

For example lets say you spent 20000 on a new car for your business in June 2021. Finally to calculate your monthly lease payment youll add these three charges together. Total lease charges incurred in 2021 fiscal period for the vehicle.

Miles per Gallon Calculator. Its sometimes called a bank fee lease inception fee or administrative charge. Say your business use is 60 percent and you are making a monthly payment of 400 on it.

More simply you can take a. Car lease options in your city. 78 cents per kilometre from 1 July 2022 for the 202223 income year.

Total number of days the vehicle was leased in 2021 and previous fiscal periods. If you claimed your lease payments last year subtract last years amount line 20. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later.

Keep in mind sales tax is different from all the state fees you may have to pay to register title or inspect a vehicle you lease or buy. Use this easy car lease calculator to quickly find monthly payment amount and sales tax on each payment in most states by entering basic lease parameters.

How To Write Off A Car Lease For Your Business In 2022

Business Vehicle Tax Deduction Calculator Nissan Usa

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Solved Sales Tax Deduction For Leased Car Personal Use

Writing Off A Car Ultimate Guide To Vehicle Expenses

Delivery Drivers Tax Deductions Maximize Take Home Income

Rideshare Deductions Standard Mileage Vs Actual Vehicle Expenses Rideshare Deduction Actual

Real Estate Lead Tracking Spreadsheet Free Business Card Templates Tax Deductions Music Business Cards

Section 179 Small Business Tax Deduction Universal Nissan

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Bmw Over 6 000 Lbs That Qualify For Tax Deduction X5 X6 X7 Tax Credit

All About Mileage June 1 2018 Levesque Associates Inc Mileage Small Business Owner Business Owner

Section 179 Deduction Hondru Ford Of Manheim

Potential 2020 Business Vehicle Tax Deduction Bismarck Motor Company

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Using The Section 179 Tax Deduction For New Forklift Purchases In 2021